Rubidium Use in Perovskite Solar Cells: Stability Breakthroughs and Mass Production Outlook

Perovskite cells have clear comparative advantages

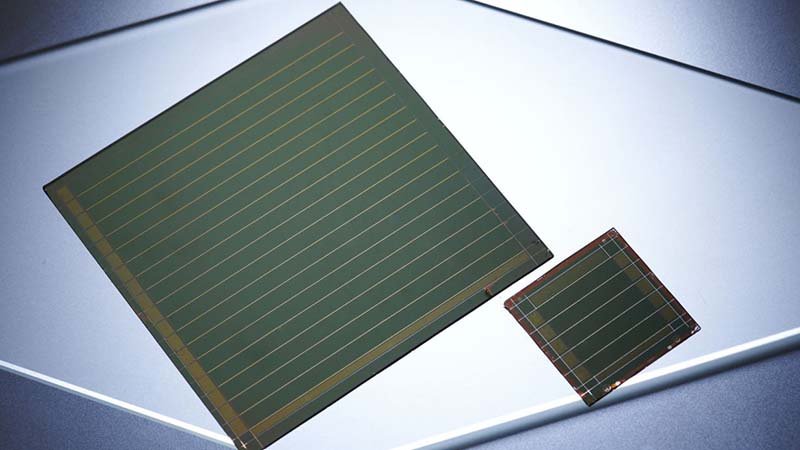

Perovskite solar cells (PSCs) are a new type of compound thin-film solar cell that uses perovskite-structured materials as the light-absorbing layer. Perovskite is a class of naturally occurring ceramic oxides, first discovered in the calcium titanate compound found in the mineral perovskite and thus named accordingly. Perovskite mainly occurs in alkaline rocks, and occasionally appears in altered pyroxenites, often associated with titanomagnetite. In 2009, Japanese scientists first used organic–inorganic hybrid perovskite materials to fabricate the world’s first perovskite solar cell device with photoelectric conversion efficiency. In recent years, industrial research on perovskite cells has continued to develop. By 2025, China domestic mass production of square-meter-scale perovskite modules has been achieved, with major breakthroughs in stability, enabling steady-state photoelectric conversion efficiency to reach 27.32%, and perovskite–organic tandem cell efficiency to exceed 28%.

Table of Contents

Perovskite cells have obvious advantages

Perovskite solar cells have obvious advantages. Compared with traditional crystalline silicon cells, perovskite cells offer multiple advantages such as low cost, high efficiency, lightweight structure, flexibility (bendability), and high weak-light performance.

- From the cost perspective, perovskite cells have obvious cost advantages:1) perovskite modules can be produced in an integrated manner, with a complete production process taking 45 minutes, while crystalline silicon modules require four different production lines and take more than three days; 2) energy consumption per watt for perovskite modules is only about 0.23 kWh, with relatively low carbon emissions, while crystalline silicon cells consume more than 1 kWh per watt; 3) investment for 1 GW of perovskite capacity is only about RMB 0.5 billion, while the total investment for 1 GW of crystalline silicon module capacity across four segments reaches RMB 1.0 billion; 4) after reaching 5–10 GW-scale mass production, perovskite cell costs can drop to RMB 0.5–0.6/W, while crystalline silicon cell costs are RMB 1.9–2.5/W.

From the efficiency perspective, perovskite cells have higher efficiency potential. The theoretical limiting efficiency of current crystalline silicon cells is 29.1%, while the theoretical limiting efficiency of single-junction perovskite cells is 33%, and the theoretical limiting efficiency of perovskite tandem cells can even exceed 40%, showing clear high-efficiency potential. In June 2024, LONGi’s commercialized M6-size crystalline silicon–perovskite tandem cell achieved a photoelectric conversion efficiency of 30.1%, setting a world record. The advantage in photoelectric conversion efficiency enables perovskite cells to significantly reduce the cost of power generation (for every one-percentage-point increase in conversion efficiency, downstream PV power plants can save more than 5% in costs), and improve space utilization, delivering higher power output with smaller area and lighter mass.

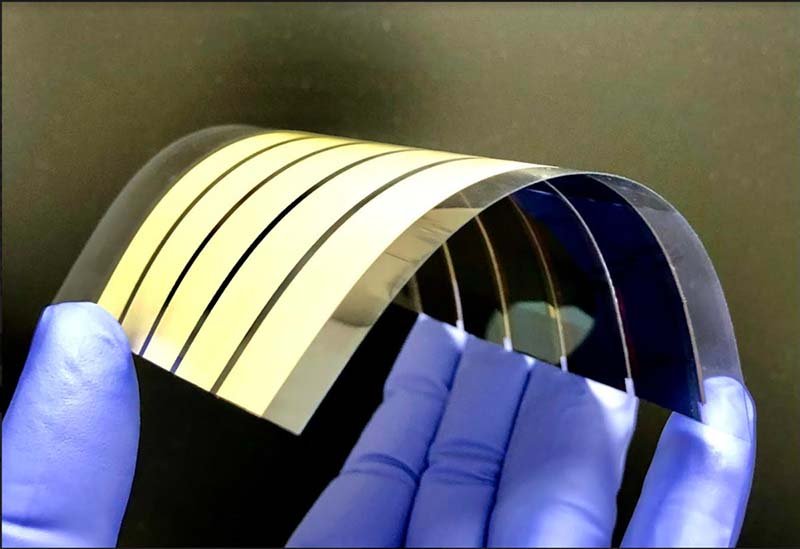

Perovskite cells are bendable and lightweight, with high weak-light performance. Because perovskite materials only need a thin film of a few hundred nanometers to effectively absorb sunlight—much thinner than traditional silicon-based cells—perovskite cells using flexible materials as supporting substrates are bendable and lightweight (a flexible perovskite thin-film cell with a thickness of 1.6 μm weighs only 1% of a traditional crystalline silicon cell; its power-to-mass ratio can reach 55.8 W/g, far exceeding the 2 W/g of crystalline silicon cells). At the same time, perovskite cells have excellent weak-light characteristics and can still generate electricity efficiently under low-light conditions.

Rubidium–cesium salts may become a key factor for the industrialization of perovskite cells

Stability constrains the industrialization of perovskite cells, and rubidium–cesium salts may become a key factor for mass production of perovskites. Because rubidium and cesium feature excellent optoelectronic properties, strong chemical activity, and easy ionization, they can be used as additive materials for the A-site cations in the ABX3 structure of perovskite solar cells, significantly improving device performance. Rubidium can increase charge-carrier mobility, improve device efficiency, and reduce current–voltage hysteresis; cesium can reduce defect density and charge accumulation in the perovskite layer, improving efficiency and long-term stability; their synergistic effect can integrate the advantages of inorganic cations, and mixed use can achieve a balance of performance.

- From the academic research side, in early 2026, the Swiss Federal Institute of Technology Lausanne (EPFL) published two studies in Nature Communications and Science, confirming that regulating perovskite structure and interfaces through rubidium-ion modification is one effective approach to improving the efficiency and stability of perovskite solar cells. In the first study published in Nature Communications, the EPFL team used a crown ether complex to precisely deliver rubidium ions to the grain boundaries of perovskite thin films, thereby improving defect passivation and charge transport. Solar cells fabricated based on this perovskite film achieved a certified best efficiency of 25.77% and retained 99.2% of the initial efficiency after 1,300 hours of continuous light-soaking tests, demonstrating excellent operational stability. In another study published in Science, the team doped rubidium ions into wide-bandgap perovskites via a lattice-strain approach to suppress halide phase segregation, thereby improving material stability. Solar cells based on this film achieved a conversion efficiency of 20.65%, and the open-circuit voltage reached 93.5% of the theoretical limit, representing relatively low photovoltage loss in wide-bandgap perovskites.

From the enterprise application side, the perovskite production line put into operation by GCL Optoelectronics uses low-impurity rubidium salts (sodium and potassium contents below 5 ppm) and cesium iodide custom-developed by Sinomine Resource Group to improve stability and photoelectric conversion efficiency. The two parties have signed a long-term agreement for more than three years, and rubidium–cesium salts have obtained long-term, stable material qualification in perovskite cell applications. In addition, when Microquanta Semiconductor mass-produced perovskite modules in 2025, it also introduced cesium bromide from Sinomine Resource Group to optimize charge transport efficiency at the perovskite–silicon tandem interface.

Perovskite cells have multiple advantages over traditional crystalline silicon cells, including low cost, high efficiency, lightweight structure, flexibility (bendability), and high weak-light performance; the main factor restricting mass production and commercialization lies in insufficient stability. The service life of crystalline silicon cells generally exceeds 20 years, whereas the current practical stable lifetime of perovskite cells is only 3–5 years, with relatively fast efficiency decay during use. Considering that adding rubidium–cesium salts may improve perovskite stability, as industry research and application experiments expand and are validated, the addition of rubidium–cesium salts may play a key role in the industrialization of perovskite solar cells.

Perovskite cell penetration in the PV market may continue to rise

Perovskite cells have broad application scenarios and have become the core route for solar cell development. Benefiting from multiple advantages such as low cost, high efficiency, lightweight structure, flexibility (bendability), and high weak-light performance, perovskite cells have rich application scenarios: they can not only replace traditional PV applications, but also open up new markets in emerging scenarios such as space energy, building-integrated photovoltaics, mobile energy, and wearable devices. Globally, more than 100 companies have continued to deepen R&D in perovskite cells, with investments exceeding USD 1 billion; domestically, multiple companies have established 100 MW-scale pilot lines, and perovskite cells have become the core route for solar cell development.

Perovskite PV market penetration is expected to rise rapidly. Because perovskite stability and efficiency losses under large-area fabrication still need optimization, large-area commercial deployment is limited. Benefiting from the low cost and high cell efficiency of perovskites, perovskite cells will continuously replace traditional crystalline silicon cells. On the one hand, in ground-based PV scenarios, perovskite penetration may rise from 1.3% in 2025 to 30% in 2030. Among them, the penetration of perovskite cells in traditional PV application scenarios such as solar power stations and rooftop distributed PV may gradually increase; in emerging application scenarios such as building integration, onboard charging, and wearable devices, the flexibility and high-power advantages of perovskites over traditional crystalline silicon cells are more obvious. On the other hand, the development of space photovoltaics may drive a substantial increase in total PV industry capacity and perovskite penetration. Space photovoltaics is a core variable for the PV industry, and perovskite cells, due to their low cost and high power-to-mass ratio, may be the main development direction for space photovoltaics. In this article, we will combine analyses from both aspects to fit a forecast of overall perovskite market demand during 2026–2030, and estimate the corresponding increase in rubidium salt demand.

Flexible perovskite cells can be used in multiple fields such as building integration/wearable devices/mobile power supplies/vehicle-mounted power generation

Flexible perovskite cells have rich application fields, with clear flexible structural characteristics and high-power advantages. Relying on key characteristics such as lightweight structure, bendability, stretchability, and twistability, flexible perovskite solar cells can achieve breakthrough applications in multiple fields such as building integration, wearable devices, vehicle-mounted power generation, mobile power supplies, and portable electronic devices. Through new encapsulation processes, perovskite modules can withstand 100,000 bends and perfectly adapt to various curved surfaces (traditional silicon-based PV can withstand only 300). At the same time, flexible perovskite cells have survivability in extreme environments: the efficiency retention rate reaches 92% at -20°C (conventional PV only 65%), and the degradation rate is <3%/year under damp-heat conditions (85°C/85%RH). By 2025, the efficiency of flexible perovskite solar cells can exceed 25%, far higher than other mainstream flexible solar cells (CIGS: 14%–18%; amorphous silicon: 10%–12%). In addition, because perovskite cells can still generate electricity efficiently under low-light conditions, they are more suitable for indoor application scenarios of wearable devices. In the field of vehicle-mounted power generation, perovskite PV onboard power generation may enter a stage of popularization. In July 2025, Tesla released a patent to replace steel and aluminum with high-strength polymers to manufacture colored body panels to eliminate the painting process. In this process, Tesla embeds functional thin films in the material, including integrated electronic door-handle sensing areas, LED light films, and perovskite films. Currently, the Tesla Cyber Cab model has confirmed adoption of this technology, and it may be applied to more models in the future. By 2024, demand from emerging application scenarios such as wearable devices, vehicle-mounted power generation, mobile power supplies, and portable electronic devices accounted for about 20% of perovskite cell demand. We believe that as mass production of perovskite cells becomes widespread, their flexibility characteristics and high-power advantages may drive emerging demand to become the core force for perovskite demand growth.

Perovskite cells may become the mainstream choice for building-integrated photovoltaics

Perovskite cells may become the mainstream choice in the field of building-integrated photovoltaics. Building-integrated photovoltaics (BIPV) is of great significance for achieving carbon peaking and carbon neutrality in the building sector, and is an effective means to reduce building carbon emissions, promote building energy conservation and carbon reduction, and address climate change.

According to Mordor Intelligence forecasts, from 2026 to 2031, the global BIPV market size may rise from USD 16.66 billion to USD 47.02 billion, with a CAGR of 23.06%; meanwhile, as perovskite products continue to update and upgrade, the application scale and penetration of perovskite cells in BIPV may continue to climb.

The global commercial aerospace industry is fully accelerating

The competition for low Earth orbit (LEO) resources is intense. According to Taibo Think Tank’s “2025 China Commercial Aerospace Industry Progress Data Yearbook,” there were 329 space launches globally in 2025, placing 4,517 satellites into orbit. Among them, China conducted 92 launches and placed 367 satellites into orbit. From the enterprise perspective, SpaceX holds a first-mover advantage in the global commercial aerospace industry. In 2025, SpaceX completed 170 launches (including 165 Falcon 9 and 5 Starship launches), setting a new historical record; among them, Starlink satellite launches occurred 122 times, and SpaceX launched 3,190 Starlink V2 mini satellites in 2025 (accounting for 71% of global satellite launches in 2025, +63% year-on-year), averaging 26.16 satellites per launch. By the end of 2025, the number of Starlink operational satellites in orbit exceeded 9,400, making it the world’s largest LEO satellite constellation, accounting for 75% of the world’s active satellites in orbit (about 12,600). Behind SpaceX’s rapid development, geopolitical factors have also played a role. The U.S. government is one of SpaceX’s most important customers; SpaceX has obtained more than USD 9 billion in contracts and funding from U.S. government agencies such as NASA and the U.S. Air Force. In January 2026, the U.S. Federal Communications Commission (FCC) approved SpaceX to add 7,500 Starlink V2 satellites (50% of which must be launched and put into operation before December 2028), and the total number of approved Starlink V2 satellites has now reached 15,000. In addition to SpaceX, Amazon has launched Project Kuiper, planning to build a large LEO satellite constellation to provide broadband internet via a constellation of more than 3,000 satellites in near-Earth orbit; the European satellite operator Eutelsat has also ordered 550 satellites to maintain OneWeb constellation operations, with delivery expected to begin by the end of 2026; Russia’s “Dawn” constellation plan will launch the first 16 satellites in 2026 and launch more than 900 LEO satellites before 2035. LEO resources are scarce and have major strategic significance for next-generation global digital infrastructure. Under the International Telecommunication Union (ITU) “first come, first served” rule, the global commercial aerospace industry has fully accelerated, and competition among countries for LEO resources has become more intense.

According to Mordor Intelligence forecasts, from 2026 to 2031, the global BIPV market size may rise from USD 16.66 billion to USD 47.02 billion, with a CAGR of 23.06%; meanwhile, as perovskite products continue to update and upgrade, the application scale and penetration of perovskite cells in BIPV may continue to climb.

China’s commercial aerospace has entered its first explosive year. In the “15th Five-Year Plan,” commercial aerospace has been clearly included as a key direction of strategic emerging industry clusters. Since then, relevant policies have continuously intensified. In November 2025, the China National Space Administration released the “Action Plan for Promoting High-Quality and Safe Development of Commercial Aerospace (2025—2027),” proposing that by 2027, at least three internationally competitive commercial aerospace industry clusters will be formed, a full-industry-chain coordination mechanism covering satellite manufacturing and launch services will be established, and the satellite application service market scale will exceed RMB 500 billion. Meanwhile, the China National Space Administration established the Department of Commercial Aerospace, and China’s aerospace information industry has entered a new stage of institutionalized and systematic development. In early 2026, China apply to the ITU 203,000 mid- and low-orbit satellite frequency-orbit resources, taking the lead in strategic positioning of key frequency bands and orbital slots over the next decade. According to ITU rules, within 7 years after filing (by the end of 2032), the first satellite must be launched, and within 14 years (by the end of 2039), the entire constellation deployment must be completed; that is, during 2026–2040, China’s annual average satellite launches must reach about 15,000. At present, China’s LEO satellite internet constellation plans include the “GW constellation,” the “G60 constellation,” and the “Honghu-3 constellation,” with a combined launch plan of nearly 38,000 satellites during 2026–2030. Based on current and planned data, during 2025–2028, China’s satellite launches may rise from 367 to 6,500, requiring nearly an 18-fold increase in three years, with a compound annual growth rate of 161%, and China’s commercial aerospace may have entered the first year of industrial explosion. Considering the accelerated global commercial aerospace layout, the rapid formation of large-scale and normalized launch capabilities in China is necessary and urgent; if frequency-orbit resources are not seized first, they may be squeezed or even reclaimed, and China’s space security strategy may be constrained. Referring to forecasts for SpaceX, Amazon Kuiper, and China’s three major LEO satellite internet constellations during 2026–2030, global LEO satellite launches of major constellations may rise from 6,430 in 2026 to 26,400 in 2030 (CAGR 42%), while China’s share may rise from 12.9% to 43.2% (China’s launch CAGR may reach 93%).

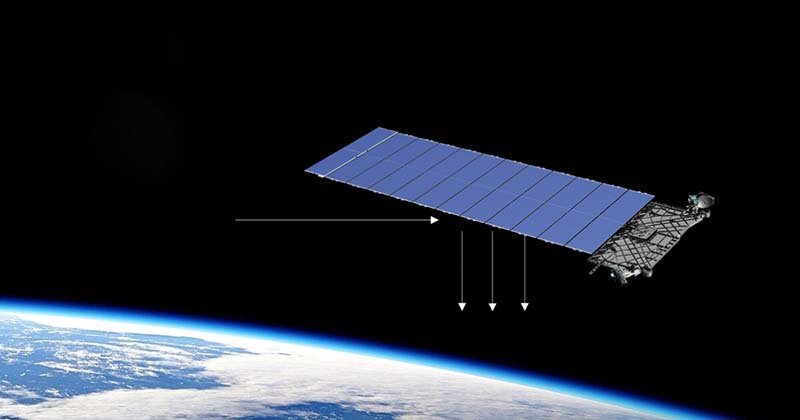

Space computing centers may drive exponential growth in demand for space photovoltaics

Perovskite cells are the main development direction for space photovoltaics. Space photovoltaics refers to solar arrays that power satellites; there are currently three main technical routes: triple-junction gallium arsenide (GaAs), P-type heterojunction (HJT), and perovskite tandem cells. GaAs currently still dominates the space PV market and is used in batches for high-value satellites. However, with the explosive increase in planned LEO satellite launches, GaAs’s high cost (RMB 1,000/W) and capacity limitations due to low raw material supply (global annual capacity only about 150 MW) make it difficult to meet the mass-production development of commercial aerospace. Therefore, HJT cells, with lightweight advantages (thickness about 50–70 μm), have begun to gradually replace GaAs cells; for example, Risen Energy has delivered small batches of HJT ultra-thin cells to Starlink (accounting for more than 30% of its procurement). Because perovskite cells have higher theoretical efficiency, lighter weight, better flexibility, and lower cost (1/10 of GaAs), the industry generally believes they will become the long-term development direction of space photovoltaics. However, perovskite cells still need to undergo longer-term certification (about 1–2 years) in aspects such as mass production and on-orbit stability. Considering the natural compatibility between HJT’s low-temperature process and symmetrical structure with perovskite tandem technology, the mass-production cycle of transitioning from HJT to perovskite cells is expected to be shortened. Currently, perovskite cells of a subsidiary of Shanghai Gangwan (Shanghai Fuxixin Space) have completed part of on-orbit verification: Juntian-1 03 satellite was launched in November 2024, and perovskite cells have operated stably in orbit for more than one year, completing nearly 100 imaging experiments; Tianyan-24 satellite was also launched in November 2024, and perovskite cells have operated stably in orbit for more than one year, with output voltage maintained at 2.8–3.0 V and almost no degradation. Considering the current development stage and validation cycle of perovskite cells, we believe 2026–2027 may be the golden period for industrialization development and validation of perovskite cells; after 2028, perovskite cells may gradually achieve mass-production deployment in space photovoltaics and become the preferred choice.

Space computing center construction may drive exponential growth in demand for space photovoltaics. In January 2026, Musk announced that after 2029, an annual PV capacity build-out of 200 GW would be achieved. Among this, Tesla will lead the construction of 100 GW of U.S. ground-based PV capacity, while SpaceX will build 100 GW of space photovoltaics. In Musk’s plan, future space photovoltaics will not only serve as supporting energy for spacecraft, but also become the energy core for space computing centers. On January 30, 2026, SpaceX submitted an application to the Federal Communications Commission, planning to launch up to 1 million Starlink V3 satellites to build an “orbital data center.” Each Starlink V3 satellite has 1,000 Gbps download and 200 Gbps upload bandwidth, with capacity 20× that of V2 satellites, and weighs about 2,000 kg each. Larger capacity and weight mean higher energy demand: the solar array area per V3 satellite increases from 22.68 m² for the V1.5 version to 256.94 m², and PV demand per satellite increases by 11× compared with V1.5. According to Risen Energy’s capacity planning analysis, 1 GW of space PV can be applied to 30,000 Starlink V2 satellites; after conversion, the corresponding number of V3 satellites is 2,648. Combining Musk’s two major plans—100 GW space photovoltaics and a “orbital data center” of 1 million satellites—we believe that from 2029 onward, SpaceX may complete one-quarter of its 1 million V3 satellite launches each year (about 250,000 satellites/year), corresponding to space PV demand of 100 GW/year. In addition to SpaceX, China also has Guoxing Aerospace’s “Star Computing Plan” and Zhejiang Lab’s “Three-Body Computing Constellation.” In May 2025, China’s Guoxing Aerospace and Zhejiang Lab jointly launched 12 satellites into orbit under the “Space Computing Constellation 021 Mission”; the plan will deploy 2,800 computing satellites in the future to build a space–ground integrated computing network covering the globe.

The development of space photovoltaics will substantially increase rubidium salt demand

Combining global commercial aerospace LEO satellite launch plans and space computing plans led by SpaceX, we estimate rubidium salt demand corresponding to space photovoltaics from two directions: commercial aerospace and space computing. On the commercial aerospace side, considering the number of global LEO satellite launches and rising perovskite penetration, we believe that from 2026 to 2030, global commercial aerospace perovskite demand may rise from 0.002 GW in 2026 to 0.44 GW in 2030; corresponding rubidium salt demand may rise from 0.02 tons to 3.23 tons, with a CAGR of 279%. On the space computing side, combining SpaceX’s space PV and million-satellite launch plan, we believe perovskite demand corresponding to space computing may reach 30/50 GW in 2029/2030, corresponding to rubidium salt demand of 220/367 tons

The global rubidium salt market has entered a new expansion cycle from 1 to N

From 2026 to 2030, perovskite industry expansion may correspond to a rubidium salt demand CAGR of 94%. The advantages of perovskite cells—low cost, high efficiency, lightweight structure, and flexibility—give them significant room to increase penetration in the PV market. Meanwhile, in emerging application fields such as building integration, wearable devices, mobile power supplies, portable electronic devices, vehicle-mounted power generation, and space photovoltaics, demand for perovskite PV also has room for sustained growth. Combining our forecasts for perovskite installations and corresponding rubidium salt demand in ground-based PV and space PV markets, we believe that from 2026 to 2030, global perovskite installations may rise from 20 GW to 281.7 GW, corresponding global rubidium salt demand may rise from 146.7 tons to 2,065.7 tons, with a CAGR of 94%.